Why online payment gateways are central to business scalability

Digital payments are accelerating globally. According to the latest reports, the global value of digital payment transactions stands at USD 7 trillion. This marks an impressive halfway point and emphasises the continuing trend towards a digital-first approach in global economies.

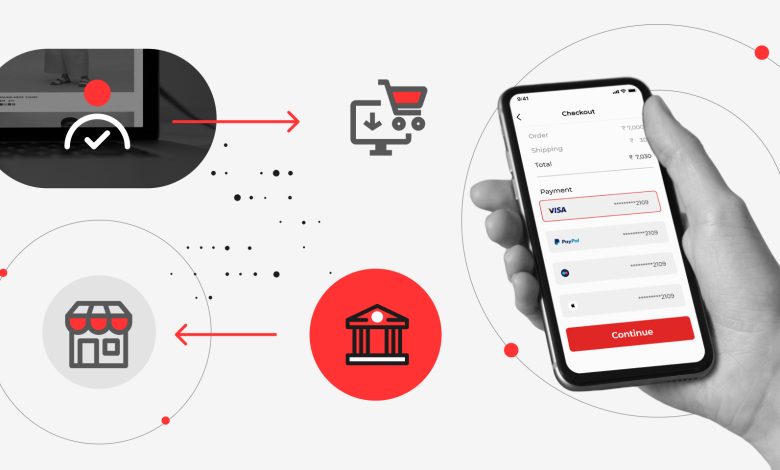

Customers now expect faster checkouts, consistent payment experiences and flexible options across channels. For businesses, this makes payment infrastructure a growth enabler rather than a support function.

An online payment gateway plays a critical role in managing rising volumes while maintaining speed, security and operational control. Let’s examine why this infrastructure sits at the centre of business scalability.

Scaling transaction volumes without operational strain

Growth usually brings sudden spikes in transaction volumes. A well-designed online payment gateway processes high volumes without affecting transaction speed or reliability. It supports multiple payment methods through a single integration, reducing checkout delays during peak traffic periods.

Automated transaction routing helps improve approval rates by selecting optimal processing paths. This stability allows businesses to scale promotions, seasonal campaigns and new launches with confidence. When payment performance remains consistent, operational teams avoid firefighting and focus on growth initiatives.

Enabling multi-channel and omnichannel expansion

Modern customers move seamlessly between online platforms and physical locations. An online payment gateway connects digital checkout journeys with Point-of-Sale (PoS) systems, ensuring consistent payment handling across channels.

It integrates smoothly with PoS machines, mobile payments and web-based checkouts using a unified backend. This approach simplifies reconciliation and reporting by consolidating transaction data. Businesses gain a single operational view instead of managing disconnected systems. As new sales channels are added, an online payment gateway ensures continuity and control.

Supporting geographic growth and market entry

Expanding into new regions introduces regulatory, currency and payment preference challenges. A scalable online payment gateway supports domestic and international payment acceptance through adaptable configurations. It enables local payment methods while maintaining centralised settlement and reporting.

Built-in compliance capabilities help align transactions with regional regulations without manual adjustments. This reduces time-to-market when entering new geographies. With the right online payment gateway, geographic expansion becomes structured and repeatable.

Strengthening security and compliance at scale

As transaction volumes rise, exposure to fraud and compliance risks increases. An online payment gateway embeds security frameworks that scale alongside business growth. Real-time monitoring tools help identify unusual patterns and mitigate risks proactively.

Compliance with industry standards is maintained without repeated system changes. This protects customer data and safeguards revenue as operations expand. Strong security foundations allow businesses to grow while maintaining customer trust and regulatory confidence.

Improving settlement speed and financial visibility

Cash flow visibility becomes critical during rapid growth phases. An online payment gateway consolidates settlement data across payment methods and channels into a single view. Automated reporting simplifies reconciliation and reduces manual errors.

Faster settlements improve liquidity planning and financial forecasting. Finance teams gain clearer insights into transaction trends and revenue flows. This transparency supports informed decision-making as scale increases.

Simplifying integration with business systems

Scalable growth depends on seamless system connectivity. An online payment gateway integrates with accounting platforms, order management systems and analytics tools without heavy customisation.

Standardised integration frameworks reduce deployment timelines when expanding operations. This eliminates data duplication and manual intervention across teams. Businesses can launch new services without rebuilding payment infrastructure. Integration flexibility makes the online payment gateway a long-term scalability asset.

Delivering consistent customer payment experiences

Customer experience determines whether growth is sustainable. An online payment gateway supports smooth, intuitive checkout journeys across devices and platforms. It adapts to customer payment preferences and regional requirements without friction.

Reduced payment failures improve conversion rates and repeat transactions. As customer bases expand, experience consistency strengthens brand credibility. Reliable payments ensure scalability does not compromise customer satisfaction.

Enabling data-led growth decisions

Growth strategies rely on actionable insights. An online payment gateway provides detailed visibility into approval rates, payment preferences and transaction behaviour. Performance dashboards highlight optimisation opportunities across channels and regions.

This data helps businesses refine pricing, promotions and customer journeys. Leaders can scale operations with clarity rather than assumptions. Payment intelligence turns the online payment gateway into a strategic decision-support system.

Building resilience for long-term scalability

Sustainable growth requires systems that adapt over time. An online payment gateway supports modular enhancements without disrupting ongoing operations. New compliance requirements or feature upgrades integrate smoothly into existing workflows. This operational resilience reduces downtime risks during expansion phases. Teams remain agile while maintaining service continuity. A future-ready online payment gateway provides stability throughout growth cycles.

Scalable payments as a foundation for growth

Business scalability depends on systems that grow without friction. An online payment gateway provides the foundation required to manage increasing volumes, expanding channels and evolving compliance needs. It brings together transaction processing, security, settlement visibility and customer experience within a unified framework.

As businesses expand across markets and touchpoints, payment reliability becomes a strategic differentiator. Payment gateways such as Pine Labs Online are built to scale without operational strain. Investing in the right online payment gateway ensures growth remains controlled, efficient and sustainable over the long term.